So in nearly done in the round up of UK earning credit cards I am covering two less well airline earning options.

FLYBE

Offer being run at the moment which is supposed to end in November which allows you to activate the card and earn a return flight.

Offer being run at the moment which is supposed to end in November which allows you to activate the card and earn a return flight.

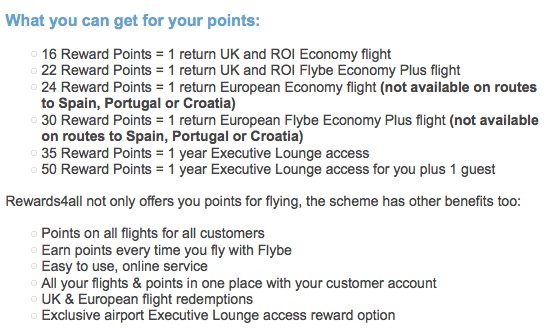

flybe uses 4allpoints as their measure of earning. You earn one for each £250 spend.

0% for 9 months on balance transfer within 90 days. 18.9% APR

Measure

Using the £12,000 per annum spend = 48 reward points.

A little hard to compare exactly with BA/bmi/LH but table below shows 2 round-trips from the UK to Europe (except Spain, Portugal or Croatia) – so better than LH by a long way.

UNITED AIRLINES – UK CREDIT CARD

With hundreds of thousands of United miles on offer from credit cards in the US, it’s a little disappointing to see their dismal efforts in the UK. May I present the MBNA American Express card.

15,000 miles for £750 spent in 90 days

15,000 miles for £750 spent in 90 days

1 mile for each £1 spent

0% on balance transfers (in 90 days – 3% fee), card purchases (90 days), and money transfers (in 90 days – 4% fee)

16.9% APR

Measure

£12,000 = 27,000 miles earned. No Status miles.

Earns enough for one Economy round-trip within Europe, although that would take you as far as Turkey.

Summary

Neither of these cards are especially good way to earn miles in comparison to the other reviewed – Lufthansa and BA/bmi

Excellent post, Im surprisingly enlightened