A new card has launched in the UK recently which might well change how we all use our current cards. Curve is a plastic card like other, including Contactless payment, but rather than sending you a bill each month, it charges a pre-registered existing credit or debit card. The produce has been launched by a UK based company.

Whilst a little like the Supercard from Travelex, in that offers no foreign exchange fees, the customer service I have received from Curve so far has been extraordinarily different.

For those that read regularly you may recall a huge fraud on my Supercard through a cloned card. (I think as part of the massive data problems that Hyatt had last year.) The Supercard call centre was a nightmare and whilst they credited me for nearly all transactions made by the fraudster, they were adamant that one was legitimate. Fast forward and after sending a claim in via the Small Claims Court, they issued the refund. It left me with a bad taste and so my (less than) Supercard languishes in a drawer deactivated and never to see the light of day again.

So Curve was a pleasant surprise. First off, it is Beta test – your box for the card clearly shows that and the staff are quite open that they are looking for 10,000 testers to see how it goes.

You can apply for the card via their web site and then download the app – iPhone only for now though – and link your Curve card to any number of other cards. Once loaded you pick which card you want to be charged and you can change this between transactions. The advantage = no foreign exchange fees. This means for example, that you use your Curve and charge to your BA Amex in establishments that don’t take Amex as the Curve card is a Mastercard. This is the use I have been making as I head towards my 2-for-1 BA voucher through spending on my UK Amex.

The card has a PIN, as well as working in swipe machines and for Contactless payments.

The exchange rate is pretty good too – Mastercard exchange rate plus just 1%. A much better rate than at a bureau-de-change.

The app instantly notifies your of a transaction made on the card and is where you upload and store all the cards you might want to use. It also shows you a record of all the transactions made via Curve. You can label the transactions, to perhaps keep work and personal expenses separate. Soon you will be export these transactions to .csv files for analysis in other software applications.

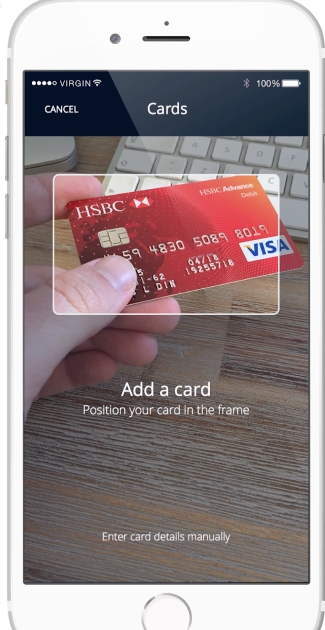

Adding a card is as simple as scanning in via the app.

The basic card costs £35 per annum and the black card £75. They are expecting to launch a loyalty scheme in the summer, but didn’t have firm details of that when I talked to their marketing team. For a limited time the £75 card comes with a free black Tumi wallet with, you guessed it, room for one card – the Curve card obviously – the only one you’ll need. The hard launch is coming in the summer, but if you apply now they will consider you for the trial. I am told that there are still spaces available.

So what’s my experience to date, having had it for about 4 weeks?

Actually really good! I have used it in the US and the UK. Where a rogue foreign transaction fee appeared for a US transaction and I sent in a query, I had a reply in less than 24 hours explaining the situation and offering an immediate refund. (Compare this to the Supercard experience I mentioned!) In the early days I had a PIN problem, and they proactively noticed that I had used the wrong PIN. And then they contacted me about how they could sort it out. Imagine a supplier who sees a customer with a problem and proactively tries to help!

A word of caution. Some other bloggers have been suggesting that the Curve is ripe for Manufactured Spending. It’s not. There is a fair use policy, and in my chat with the marketing team it was clear they knew all about this type of activity. You won’t be able to make lots of cash withdrawals – they will spot it, rest assured!

Hi!

Long time reader, first time commenter. RE cash withdrawals, did they give you an indication of what their fair usage policy is? I take out around £250 a week currently. Would you see that being an issue?

Really great concept. They even offer a £10 statement credit for new customers – just use code LYvmD when signing up.

@Ryan – I think they will take a sensible view – but if all you do is cash advances I think they might cut you off.

That would be the code that also gives you a £10 credit would it Frank? Nice try.

Is the iPhone only needed to change which card you use on it? Iversion recently changed to an android phone but could I just have the app on my old phone for when I want to switch cards?

I signed up months ago but sadly they’ve still not sorted out an Android app so I’ve had to out the order on hold. Disappointing they’re still iOS-only. By comparison the Supercard worked a treat for me recently in both Poland and Germany, with fee-free purchases and credit card withdrawals. I’d love to use Curve for places where Amex is accepted but I’m not going to be buying an iOS device just to do so.

BTW Haha what a comment from Frank, so utterly selfless of him to post his personal referral link to receive £10 himself 😛

@Michael – There is, I think, an android app coming but for the meantime you can use the iPhone app to change cards. You need to look at it if you want more information, but not otherwise needed.

Unfortunately the Android app (according to my email discussion with the Curve team) is still at the early planning stages. They’re saying Summer but I suspect it’ll be later than that.

AIUI you need the app both to switch cards and to look at any transactions.