With a huge thud the package above arrived at home recently. A few days after Amex confirmed that they would offer me a Platinum card it had come.

The pack is about an inch thick and I wasn’t sure what it was in truth until I read the return address on the back.

Opening the pack your card is packaged on the right of the cover, so you see it right away.

I’ve removed it – clearly – for this article. You need to activate it, which you can do online.

Let’s roll back as to why I wanted one, coming, as it does with a pretty steep membership fee. My Gold card had been fine for some time, but I was missing the chance to use the Centurion Lounges in the USA on my trips and wanted access to the Fine Hotels and Resorts offer as I am going to a couple of places this year where chain hotels don’t exist! Plus of course it comes with a couple of hotel elite offers.

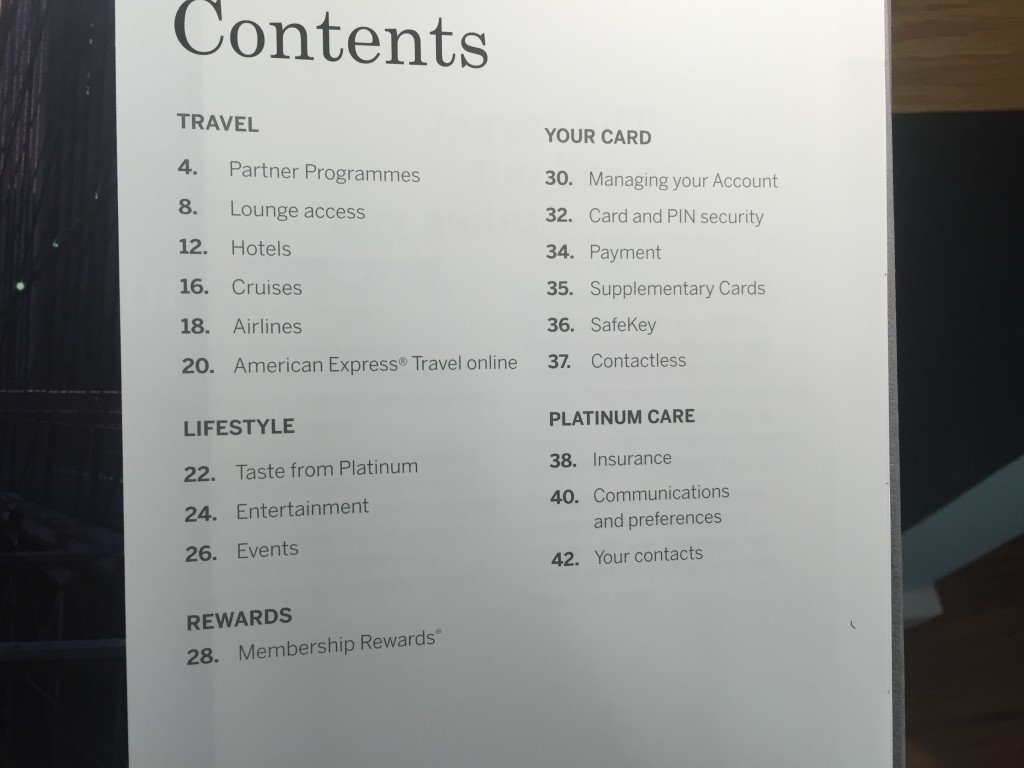

The Contents showed the details and benefits of the card:

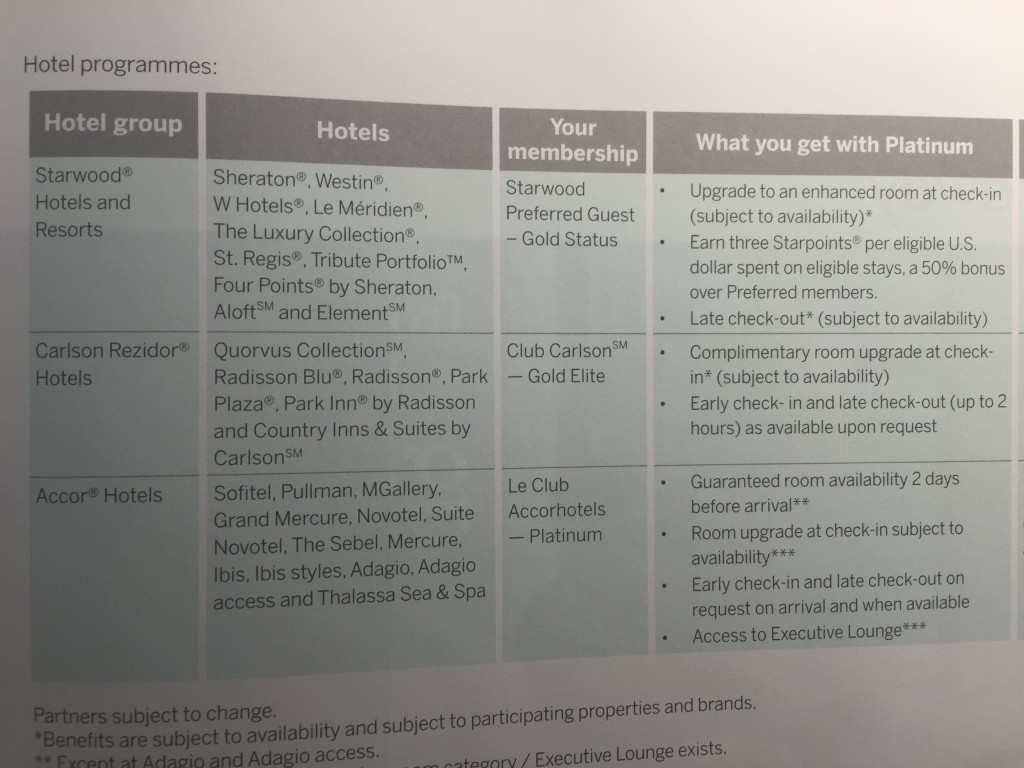

The hotel offers were on the next page:

I quickly signed up for the Starwood, Club Carlson and Accor offers. The Accor one was processed first, followed by Starwood. The Club Carlson caused a new account number to be created as the email addresses for Amex and my current Club Carlson account did not match. A couple of phone calls sorted that out.

The rest of the pack was pretty predictable, and if you hold an Amex now or even another card, you are likely to understand a great deal of what was being said.

The back had a pile of insurance information – noting that the delay insurance etc. only applies if you book using the Platinum Amex – I filed them for later.

Of course, the two DYKWIA baggage tags were at the very back. Consigned now to a drawer.

The Priority Pass pack arrived on the same day which is pretty impressive. I also have PP through my bank account, but this one allowed me to register in the app for an electronic card that I can hold on my phone. This was useful, as was the new catalogue of clubs.

The UK card doesn’t come with the travel credits that the US card enjoys and so there is no direct P&L for the fee. But, I do know that I will be in Las Vegas in two weeks on a three hour connection from AA to BA. The card means that I can spend it in the rather lovely Club there. Of course I could have paid $50 for the same right, but somehow this seems a better way to go. You can read my review of this lounge here.

The card comes with Hertz Gold Rewards membership and Avis Preferred. However, as a non-driver these offer no advantage to me.

The card does come with access to the Eurostar lounges in Paris and London and I look forward to using those in 2016. They can make the packed waiting area more bearable.

The Delta SkyClubs also offer access to the card holder when flying with them.

6 cruise lines (Crystal, Regent, SeaDream, Seabourn, Silversea and Holland America) all offer deals for card holders. You have to book a cruise for 6 nights or longer to benefit.

There are no airline elite benefits with the UK card.

Now, I just need to call Amex and cancel the Gold Card now – don’t need two!

I thought if you applied for the Platinum while holding the Gold then you don’t get the bonus points? Or did you want the card more for the other benefits?

@Tim – correct not bonus points for me

For the Eurostar lounge access – some places say it only covers the St Pancras and Paris ones, other places say it covers St Pancras + Paris + Brussels (there’s no lounge in Lille). I’ve never had any issues getting into the Brussels lounge with mine, so I think it’s an oversight in places that only list the 2.

One other big benefit is the travel inconvenience insurance. It has covered a hotel and a nice dinner for me when my onward train was cancelled in a SNCF strike, and just after the Rome airport fire covered the fare difference between a refund from Vueling on a flight they’d cancelled and rebooking on a still-operating Alitalia plane. Keep the travel insurance PDF with you to double check the details and qualifying rules, but can make a bad situation bearable!

Can an Anerican living in the UK get this card?

Surely a better approach would have been to use the upgrade to platinum route as an existing gold card holder? You’d then have got a 15k MR bonus for £1k spend in 90 days…