Since I reviewed the Priority Club VISA card some months ago, they have launched a second card in the UK. Applications via this link (not sponsored).

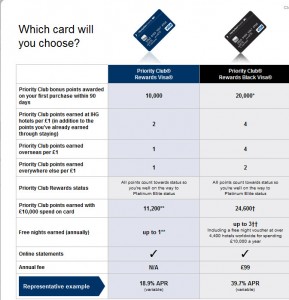

The differences are summed up by the Helpful table on the site:

Clearly the big issue is the £99 joining fee and hence the increased APR. However, the very attractive 20,000 points (40% of the way to Platinum Priority Club) might be worth it.

In addition if you earn a lot of your miles from staying at IHG hotels, then this seems a good deal to me.

Well I certainly agree with you that the big issue is the joining fee. [And thanks for posting this, I had missed it.]

However rather than viewing the 20k joining bonus as a plus, I’d consider 20k bonus on this card to be a far worse joining bonus than you recieve with the free card!

– Obviously this all comes down to what value you place on a PC point. Personally I value 5k PC Points at 25 GBP, that is my ‘working figure’ (effectivly 0.5p each). Therefore, the 20k joining bonus is essentially absorbed by the 99 GBP fee! I.e. joining bonus = 0.

With the free card, the 10k (which I’d value at 50 GBP) is essentially free.

That is obvioulsy only considered in terms of joining bonus. Not earnings from spend.

In terms of earnings from spend:

Basic card:

Spend anywhere: 1PC = 0.5p per pound (or 0.5% back).

Spend at IHG: 2PC = 1p per pound (or 1% back).

[I.e. as we all knew, the basic card is not a great payer!]

New IHG Black Card:

Spend anywhere: 2PC = 1p per pound (1% back)

Spend abroad: 4PC = 2p per pound (2% back)

Spend at IHG: 4PC = 2p per pound (2% back)

After the first year, putting a priority club point value (at 0.5p per point) on the £99 annual fee = 19,800 PC points. – Therefore, you would need to earn more than an exta 19.8k PC points per year from the black card to make it worth taking over the free card.

The black card earns you an extra 2PC at IHG and when used abroad, and 1 extra PC in the UK when compared with the standard card.

Assuming we focus on IHG spend, if you would put through 9,900 GBP at IHG or abroad a year this could make sense, especially since you are essentially at the £10k required for the free night certificate. [Anythink less than 9900 GBP at IHG or abroad would need to be made up with double that ammount in the UK].

If your spend is less than that, then the black card makes no sense by comparison.

First year (or as a 1 year only card):

It makes even less sense in the first year, where the free card has 10k joining bonus and personally I consider the black card to have none.

Therefore, you need to earn an extra 29,800 PC points in year one to be ahead of the free card when considered over that one year. AGAIN, no doubt about it if you will spend over 10k at IHG/abroad etc (or more in the UK). But if not, it makes no sense.

The above is just my comparison of the two. Personally, I’d look at other cards such as the Amex Gold Charge card etc, especially if your IHG spend includes IHG abroad where it comes out on top even if your objective is to earn PC points. And you could still do the free PC card as well.

E&OE

I think the black card is ok and thats about it ..as existing customers can upgrade and have no fee for the first year and get 20k points.

You can down grade after the first year, you just got to remeber the anniversary date other wise you will have the annual fee applied.

I think the black card does not carry the prestigue status as no exceptional benefits compared to other cards i.e. AMEX Gold 95.00 for the first year, with Insurance,Free upgrades for flights and hotels.

Think they have along way to go yet