I wrote in glowing terms about Curve some weeks ago.

Manufactured Spending, has been all the rage in some Frequent Flyer circles and numerous methods, mostly US based have come and gone. The system usually means withdrawing cash or buying a gift card and then using the cash or card to repay the miles earning card used to generate the original transaction.

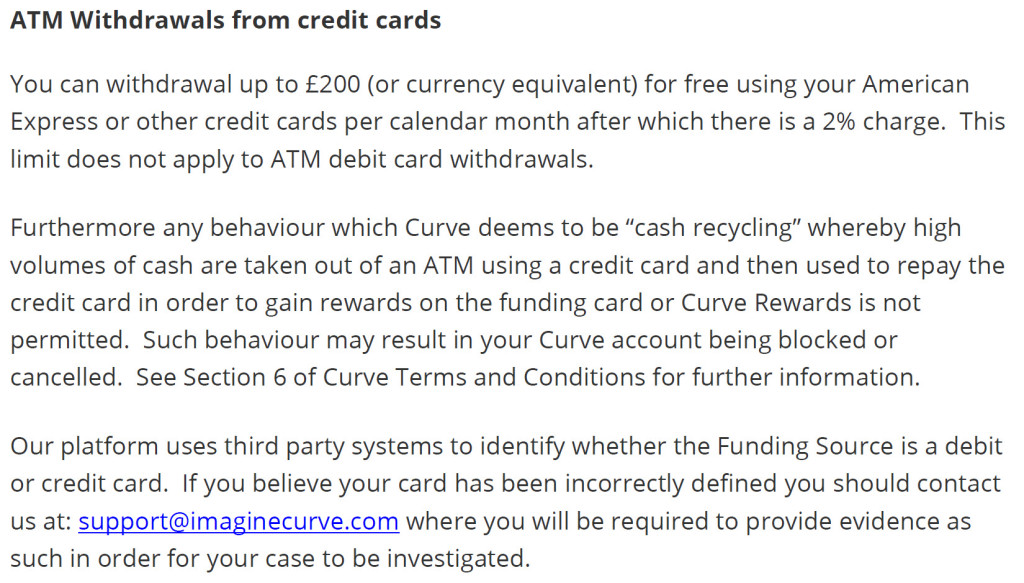

I warned in my article that Curve were wise to this and so it seems they have changed their rules to limit cash withdrawals to £200 per month, after which a 2% fee applies for subsequent withdrawals.

Pass along, no manufactured spend to see here!

Hardly surprising this has happened in truth, but a little disappointing none the less, I am still sure there is a place for the Curve card, especially with its superior Customer Service over Supercard, the Travelex alternative.

£200/month is £2,400 a year. On the old MBNA BMI Amex, that’s 4800 avios. On a BA Premium Amex, it’s 3,600 avios and 25% of a 2-for-1. Not going to get you unlimited free miles, but still enough value to be worth a couple of cash machine trips a month!

(I’d guess that anyone taking out £200 once a month might invite some scrutiny, 2-3 smaller withdrawls throughout the month is probably what most people do on their normal debit card so likely less of an issue if it’s within the cap)

Where are you seeing that?

Both the T&C’s and the email I received after activating my card state a “Maximum daily withdrawal of £200 at an ATM”

Still worth taking out the maximum, but I won’t be able to use it anyway until they launch an Android app, major oversight not to have it at launch.

Supercard still working brilliantly for me and nice to have fee free ATM withdrawals without worrying about a cap. Hope it’s relaunch goes OK!

Dig in to the web site and see the new T&C’s. The image is a screen grab of the document.